About us

Name

Foreign Non-Life Insurance Association of Japan (hereinafter called FNLIA)

Address

Toranomon-Suzuki Building 7F

20-4 Toranomon 3-chome, Minato-ku, Tokyo 105-0001

Membership

Ordinary members: 18 companies (qualification: Japanese branches or incorporated companies- with more than 50% of foreign capital -of foreign non-life insurance companies licensed to transact non-life insurance business in Japan).

Associate members: 2 companies (qualification: Representative offices of foreign non-life insurance companies, foreign non-life insurance companies intending to obtain non-life insurance license in Japan, or service providers relative to non-life insurance business (excluding insurance intermediaries).

Board members

Chairman: Edward Kopp

FNLIA Directors-list is here.

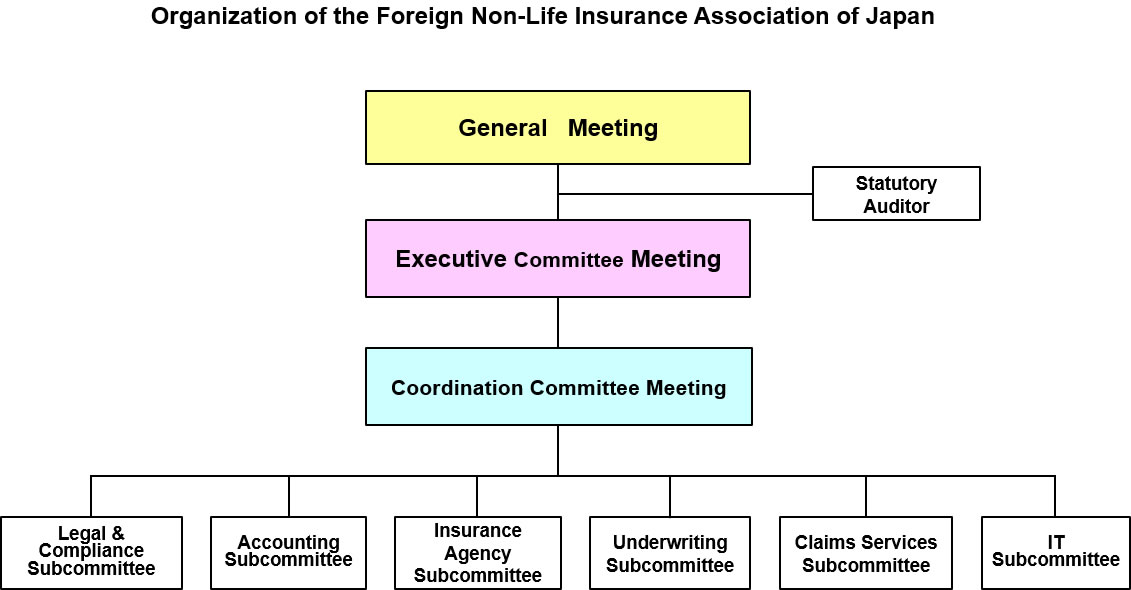

Internal organization

- Annual General Meeting(AGM), Extraordinary General Meeting(EGM)

- Executive Committee Meeting(ECM)

- Coordination Committee Meeting(CCM. A consulting body for ECM)

Activities

- Expressing opinions to represent members on various matters concerning non-life insurance business.

- Providing information concerning non-life insurance.

- Research and study on various laws concerning non-life insurance in general.

- Matters concerning Authorized Personal Information Protection Organization.

History

The modern insurance system in Japan was introduced in 1859 (the 6th year of Ansei) when foreign insurance firms’ branches and agencies commenced underwriting of fire and marine insurance for foreigners residing in free ports such as Yokohama, just after opening. It was 20 years prior to the establishment in 1879 (the 12th year of Meiji) of Tokyo Marine Insurance Company (now Tokio Marine & Nichido Fire Insurance Company Ltd.). In 1917 (the 6th year of Taisho), 29 foreign insurance companies, mainly British, were in operation, holding a market share of around 20% of the nation’s insurance industry.

With the outbreak of World WarII,those foreign insurance firms withdrew from Japan but reentered the market after the end of the war. In the beginning, they operated under the license of General Headquarters targeting at the military and tails of the occupation forces. Following the enactment of the Law Concerning Foreign Insurance Companies in 1949 (the 24th year of Showa), foreign insurers obtained the license of the Ministry of Finance and gradually entered the market for Japanese corporate business. December of the same year saw the establishment of the Foreign Non-Life Insurance Association of Japan.

In 1995 (the 7th year of Heisei), FNLIA set up an independent office managed by a full-time executive, which became legal entity as Limited-liability Chukan-hojin as from February, 2006 (the 18th year of Heisei). On the other hand, the FNLIA Coordination Committee, which succeeded Foreign Insurance Companies Liaison Committee established in 1966 (the 41st year of Showa) for the purpose of liaising with authorities concerned, was established in 1974 (the 49th year of Showa) as an internal organization of FNLIA. The said Committee comprises Japanese senior managers from member companies who have complementary role of FNLIA AGM and ECM mainly consisting of foreigners representing member compan